One of the movies I enjoyed in my childhood was called “Cool Runnings”. It was about a Jamaican Bobsled team that was trying to go to the Olympics.

The teammates were originally trying to qualify for the Olympics as sprinters but during the tryout race one of them tripped and took a couple of the other racers down with him.

This kind of reminded me about the markets performance this year.

In 2022 we have had the worst start of the year for the Nasdaq in 50 years and worst start for the S&P 500 in 80 years.

Here are some quick stats from the Nasdaq composite for worst months:

- Oct 1987: -27.2%

- Nov 2000: -22.9%

- Feb 2001: -22.4%

- Aug 1998: -19.9%

- Oct 2008: -17.4%

- Mar 1980: -17.1%

- Sep 2001: -17.0%

- Oct 1978: -16.4%

- Apr 2000: -15.6%

- Nov 1973: -15.1%

- Mar 2001: -14.5%

- Apr 2022: -13.3%

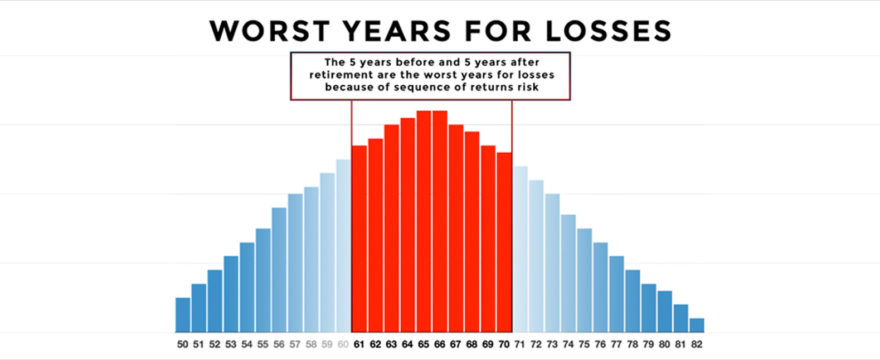

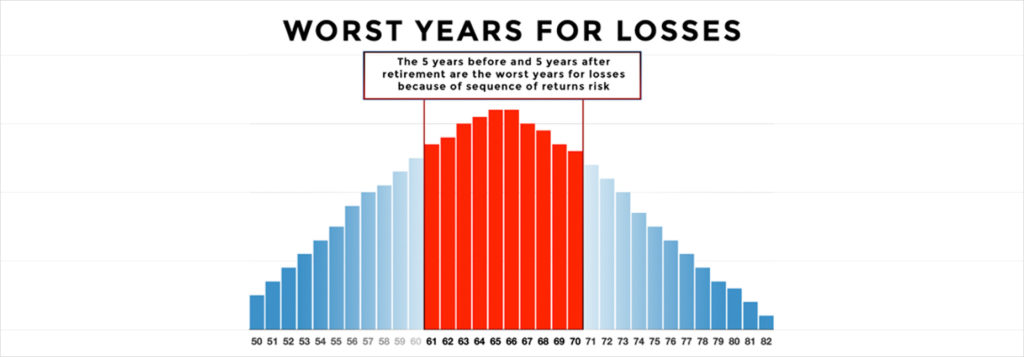

One of the concepts that I stress with my clients is called the “retirement crash zone”.

It refers to the 5 years before retirement begins and the first 5 years in retirement. This is where your biggest risk is for depleting your retirement cash flow if you have losses in those years.

Some of you may be un-phased by this year’s market drops because you are far enough away from retirement that you believe it will come back.

The thing we can’t predict is when the market will actually sustain losses and if that will be in your “retirement crash zone” or not.

Of course we have strategies to take the worry out of all of this, so if we can help in any way please reach out.

Hope you all have a wonderful Mother’s Day weekend!

Remember — It’s Your Time…