Happy New Year!

A few weeks ago my son figured out how to solve the Rubik’s cube and got really fast at it.

I was quite impressed and thought I could learn as well. I haven’t learned quite as fast but he is teaching me the strategy and pattern recognition.

Maybe ol’ dad can learn new tricks. I will report back on my progress.

With 2020 behind us we are not free of a lot of the effects and damage of what 2020 brought but there is something about changing the calendar to a new year that breathes new life into possibilities.

Many will decide to lose weight, start a business, write a book, improve their finances, develop new relationships, finally finish that invention etc. And that will work for a while until the excitement will dwindle and they go back to grabbing a bag of Cheetos and binge watching a new 8 Season show. Ha ha.

Lasting change comes from making a decision once and then recommitting each day.

As we work with our clients it is not a one time event there is constant calibration needed to adapt to your progression and the ever changing environment.

We are going to continue the video series that breaks out how one of our clients had tremendous success utilizing their opportunity fund last year to earn over $152k in less than 6 months.

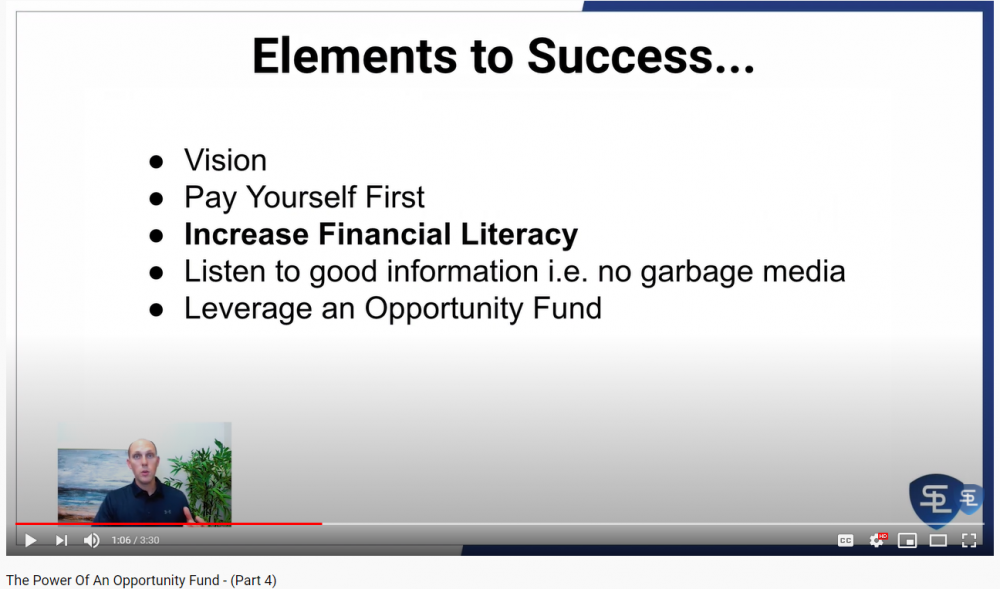

So far in the series we have discussed:

- Vision

- And Paying Yourself First

Today we are going to talk about “increasing financial literacy”, this piggybacks on the “Pay Yourself First” principle.

Over the holiday I re-listened to a seminar given by the late, Jim Rohn. He is one of my favorite speakers and business philosophers.

In that seminar he said only spend 70 cents of every $1 dollar that you make. Give 10% to God, 10% to your investments and the other 10% to invest back in yourself.

I think this is wise council. If you believe in yourself and that you are your best performing asset why wouldn’t you invest in yourself? You could learn a new skill, how to communicate more powerfully, become more healthy and vibrant so you can produce more, etc.

The ironic thing is… the more you learn the more you will realize how much you don’t know. It will allow you to become more humble and help you make better decisions.

So if you have a goal to become more financially savvy this year and create more cash flow let’s start with these steps and watch for the next few videos to see where we go from here.

Enjoy!

Remember — It’s Your Time…