Using April Fools as a platform to announce a coming recession isn’t very funny, in my opinion.

When I was a young boy me and my four brothers always loved to play jokes on each other but even better was when we combined forces against my only sister…. sorry Lori, you know we love you.

I remember one April fools day was full of classic pranks. My sister was having a bunch of her friends over for some type of fashion week party and we had everything set…

Self opening doors, whoopie cushions, disappearing folding chairs and long range TV remotes with volume blaring.

My brothers and I had a blast…my sister and her friends not so much.

The receiving end never seems to be very fun in this regard.

In efforts to try to curb inflation the Fed has raised rates slightly but has been more “hawkish” with their language about raising interest rates in the future.

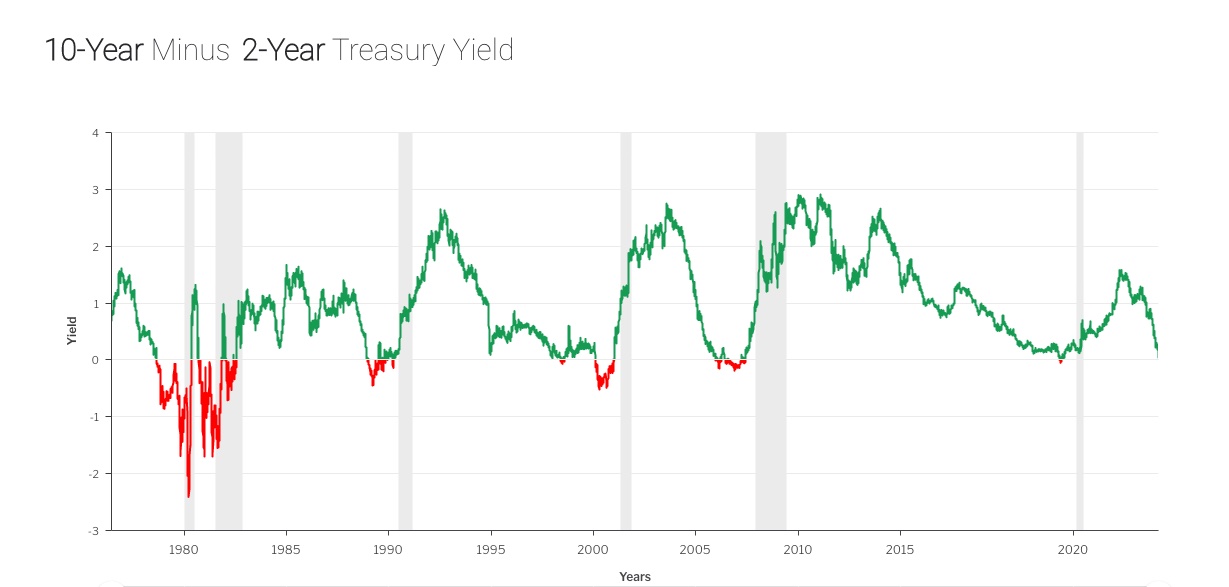

After these announcements the speculative markets have been starting to price in the adjustments to the treasuries and bond market. Now we are seeing that a yield curve inversion between the 10 year and 2 year Treasury Yield is imminent.

So why should you care about this chart…it seems so technical and boring, right?

James McWhinney a contributor for Investopedia said this:

“An inverted yield curve in U.S. Treasuries has predicted every recession since 1955, with only one false signal during that time.” (1) If you look at the timing on this chart where the yield curve has inverted i.e. the red below the zero line. We have had a major crash or correction in the markets in a short time following the 10 & 2 year inversion.

Whether it was Black Monday in 1987, the dotcom bubble burst in 2001, and the 2008 financial crisis. This is a strong indicator.

Does that mean a recession is starting right now?

Who knows but I would say it’s time to get your financial house in order.

If we can help patch or even rebuild your financial roof, let us know how we can help. With proper planning and strategy implementation the next recession doesn’t have to hurt.

Remember — It’s Your Time…

(1) https://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp