When I was growing up our family went over to the beach in California for a summer vacation. While we were there my brother and I found a convenience store where we liked to pick up something with our “lunch” money.

One day we had both already spent our lunch money but wandered into the store anyway to get out of the sun for a bit.

In the candy aisle my brother found a sign that said “free” so he grabbed a candy bar and started eating it. What it really said was “buy one, get one free.” Except he didn’t understand that part.

While he was “stealing” candy bars. I went to the back of the store and saw a pallet of 2-liter Dr. Pepper bottles. For some reason in my mischievous young mind I thought it would be funny to shake one of the bottles up so much that the next person that bought it would be in for a surprise when they opened it. (insert evil laugh here…)

However, it backfired and the bottle started spraying everywhere…all over me and the floor.

In a panic my brother and I swiftly walked out of the store but tried to play it “cool.”

Later that day when we were talking about what we had done, my mom overheard us. After getting all the details she corrected us like any good parent would and gave us money, which we would have to do chores for to pay her back, to go pay the store clerk for the candy bar and the 2 liter of soda and possibly clean up.

We were both very reluctant but there was no getting out of this.

We did as we were told and the store clerk took our money but wasn’t too friendly about it.

However, we felt a bit better knowing that we had least cleared our conscience with this payment.

One of the unfortunate things about human nature is that it takes quite a bit of emotional pressure to make us look at things we know we need to change.

Right now with the financial markets in turmoil you are probably paying a little closer attention and if you have visited with your financial advisor they may have said just “hold on for the long term” or “let’s change your allocations.”

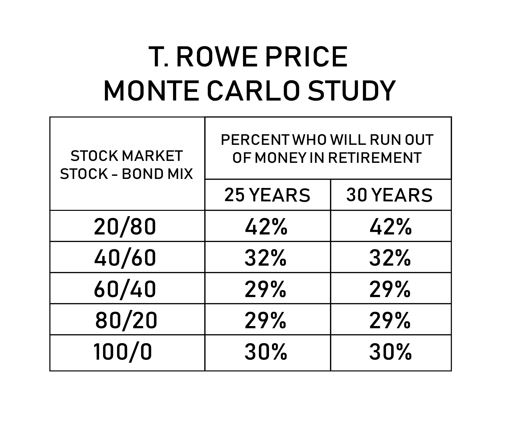

One of the things I want to bring to your attention is a study that T. Rowe Price did.

They did an extensive Monte Carlos study to determine the probability of your stock market account assets lasting throughout your retirement years.

This chart shows what they found if you withdraw 5% per year (so $50k on a $1Million account):

In other words you have a higher probability of running out of money if you have more money in the bond market?

How does that work?

Aren’t bonds safer especially in a market like we are in?

Not necessarily. If you read up about what the value of bonds do in a rising interest rate environment you will find that it is not really looking great for bonds for a while.

So am I saying go 100% to equities?

No, but you may want to consider using strategies that really diversify you from the traditional stock/bond market.

Most people only hear about stock/bonds/mutual funds etc. but they are all the same thing,… all correlated assets.

It might be time to consider truly diversifying some of your hard earned capital.

Until then watch out for the little bubbles on top of your next 2 liter bottle of soda. 🙂

Remember — It’s Your Time…